Current Gross Weighted Target IRR: 23.9%

We carefully select our investments and focus on superior risk-adjusted returns with a high diversification, and we demonstrate it with our strong portfolio. You can find some of our assets below.

Fund Target IRR 13% to 15% net to investors. All numbers are expected targets and not guaranteed.

CLOSED

Sponsor:

Location:

Asset Type:

Asset Class:

Investment:

Target IRR:

Cash-on-Cash Return:

Hold:

Hempel

Rochester, MN

Retail NNN

N/A

Equity

18%

8%

3 to 5 years

CLOSED

Sponsor:

Location:

Asset Type:

Asset Class:

Investment:

Target IRR:

Cash-on-Cash Return:

Hold:

Happy Camper Capital

Indiana

RV Camps

C

Equity

23%

~8%

3 to 5 years

CLOSED

Sponsor:

Location:

Asset Type:

Asset Class:

Investment:

Target IRR:

Cash-on-Cash Return:

Hold:

Urbaneer Investment Partners

Los Angeles, CA

MultiFamily ValueAdd

B

Equity

33%

N/A

2 to 3 years

CLOSED

Sponsor:

Location:

Asset Type:

Asset Class:

Investment:

Target IRR:

Cash-on-Cash Return:

Hold:

Louisiana Green Fuels

Louisiana

Industrial – Carbon Credit

N/A

Equity

42%

None in the first years

5 to 10 years

CLOSED

Sponsor:

Location:

Asset Type:

Asset Class:

Investment:

Target IRR:

Cash-on-Cash Return:

Hold:

Equity Multifamily

Central FL

Hotel to MultiFamily Conversion

C

Equity

53%

8%

3 years

CLOSED

Sponsor:

Location:

Asset Type:

Asset Class:

Investment:

Target IRR:

Cash-on-Cash Return:

Hold:

Various

Various

Mobile Homes

C

Equity

~17%

~8%

~7 years

CLOSED

Sponsor:

Location:

Asset Type:

Asset Class:

Investment:

Target IRR:

Cash-on-Cash Return:

Hold:

BV Capital

TX

Land Acquisition

N/A

Pref Equity

12-20%

N/A

6-12 months

CLOSED

Sponsor:

Location:

Asset Type:

Asset Class:

Investment:

Target IRR:

Cash-on-Cash Return:

Hold:

Trion

Orlando, FL

Multifamily Value Add

A

Equity

21.2%

8%

4 years

CLOSED

Sponsor:

Location:

Asset Type:

Asset Class:

Investment:

Target IRR:

Cash-on-Cash Return:

Hold:

ApexOne

TX, LA, AL, FL

Multifamily Core +

A

Equity

16-18%

5%

5 years

CLOSED

Sponsor:

Location:

Asset Type:

Asset Class:

Investment:

Target IRR:

Cash-on-Cash Return:

Hold:

RREAF

Boise, ID

Hotel Development

N/A

Equity

24.7%

10%-12%

3 years

CLOSED

Sponsor:

Location:

Asset Type:

Asset Class:

Investment:

Target IRR:

Cash-on-Cash Return:

Hold:

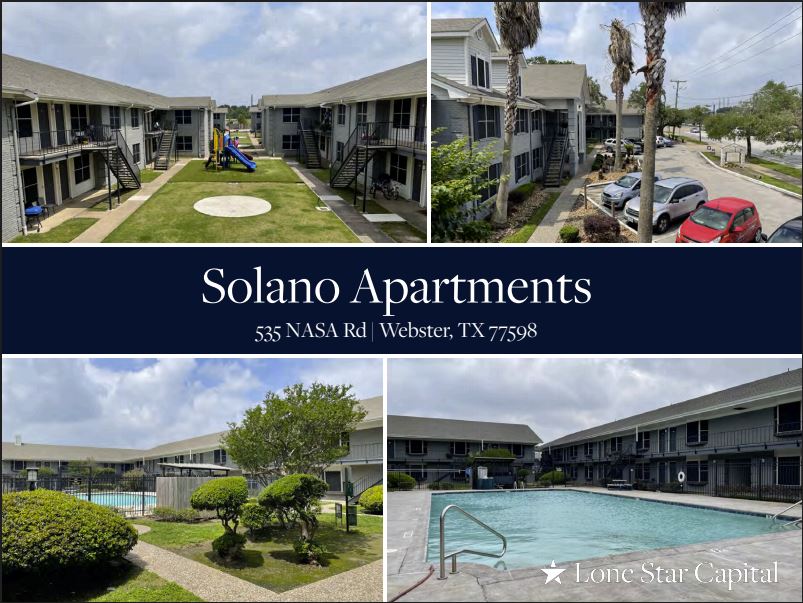

Lone Star Capital

Houston, TX

Multifamily Value Add

B-

Equity

19.5%

8.7%

5 years

CLOSED

Sponsor:

Location:

Asset Type:

Asset Class:

Investment:

Target IRR:

Cash-on-Cash Return:

Hold:

BV Capital

Dallas-Fort Worth, TX

Multifamily Student

A

Equity

20.25%

9.8%-13.4%

5 years

CLOSED

Sponsor:

Location:

Asset Type:

Asset Class:

Investment:

Target IRR:

Cash-on-Cash Return:

Hold:

Tavros / Arel Capital

NYC, NY

Mixed Redevelopment

A

Pref Equity

15%

7%

2 years

CLOSED

Sponsor:

Location:

Asset Type:

Asset Class:

Investment:

Target IRR:

Cash-on-Cash Return:

Hold:

Various

Various

Industrial

Various

Debt

15%

15%

1 year lock