Here is a webinar we did in December 2022 discussing the impact of current interest rates on Real Estate.

Transcript:

Welcome to our December, 2022 webinar. Here we’re going to talk about the interest rates.

Very quick intro about ourselves.

We are investors. We are investing in a bunch of syndications through a fund that we created. So I put here some email, down there, my email, Saikrishna’s email, Jeff’s email if you folks want to contact us and you have more questions about the content or whatever we are doing. But the purpose here, this presentation, is to talk about kind of what’s happening with the interest rate and not selling you anything or whatever.

The topics we’re gonna talk about here is going to be the overall economic situation. Why we are here right now in this current situation. What’s the relationship between interest rates and mortgage rates. What are the expectations for mortgage rates in 2023 and 2024.

What’s the impact of right now? What’s going to happen for one to four units market and the impact on commercial real estate as well. We’re going to chat a bit about the headwinds and tailwinds expected and kind of some of the thing that could happen on the commercial real estate with floating rates.

And then there will be some discussions about final thoughts, on kind of how to better invest for 2023 and 2024. I’ll take the question at the end. So there is a chat on Zoom so we can type your question and I’ll answer them in order.

All right. I’m going to go through that quickly. There is a lot of content, so I’m going to not go too much in details, but here is why we are in this current situation right now. So after the 2008 recession to stimulate growth, the interest rates and mortgage rates have been artificially lowered, for a long period of times.

And so that continued actually. decreasing those rates until 2015 when the Fed tried to raise the rates, until 2018, but they got slapped the hand especially when there was 2019 US China trade conflict. Trump even said that he would fire Powell if he would not lower the rates to, and to inflate the economy.

Then after that, COVID exploded in March, 2020. Various markets imploded everywhere in the world, and so significant liquidity got added to the market, and rates were artificially kept low again. So in 2022, due to this strong addition of money and the supply chain issues, we started to see some inflation.

Initially it was like temporary, but that was not really temporary. It started to kick in and the real estate and especially the single family home market got overheated and it was due to extreme low mortgage rates and people adapting to remote work. That was kind of the new world where people moved from states to states .

Some people left, for example, New York to move to Florida and so on. And that created a lot of increase, in terms of pricing in Florida, for example. And the Fed continued to buy billions of dollars of bonds to stimulate the economy. Pretty much. They bought bonds, they bought the mortgage backed securities which will kind lower the rates for all the bonds and for the mortgage as well. Then in early 2022, Russia Invasion of Ukraine created a shock in the energy market. Continued disruption of the supply chain, which was amplified by the continued zero Covid policy from China. And the inflation was still strong, hurting consumers.

And so that’s threatening the economy as a whole. And kind of what Powell was saying is like, well, with a price instability, the economy does not work for anyone. So to fight inflation in 2022, the Feds started increasing interest rates because they wanted to avoid a repeat of what happened in seventies, in the late seventies and early eighties where the inflation was so high that it created a huge shock and so on. Remember the Volker’s years and so on where they had to increase the rate to 10- 15%. And so they stopped buying treasuries and mortgage based securities. And so within nine month, pretty much overnight rate increased from 0.25% to 4.5%.

So that creates a shock in the market. Created some slowdown with bonds and stocks, and especially growth stocks being pummeled for the past 10-12 months now, and with an increase of probability for recession in the US and the rest of the world. That’s kind of a difficult dance that fighting the inflation, the Fed has to raise the rate and that creates a difficult dance by slowing down the economy to decrease the inflation at the same time, they don’t want to decrease it too much, otherwise you create a recession.

So I’m going to kind of paraphrasing what Jerome Powell said when they increased the interest rate is, “some of you will suffer, but that’s a sacrifice I am willing to make” and, and, it’s kind of tongue in the cheek here, but it’s pretty much what he said. He really said in something that, that he’s expecting that people will suffer and that’s the only way to bring down kind of the inflation.

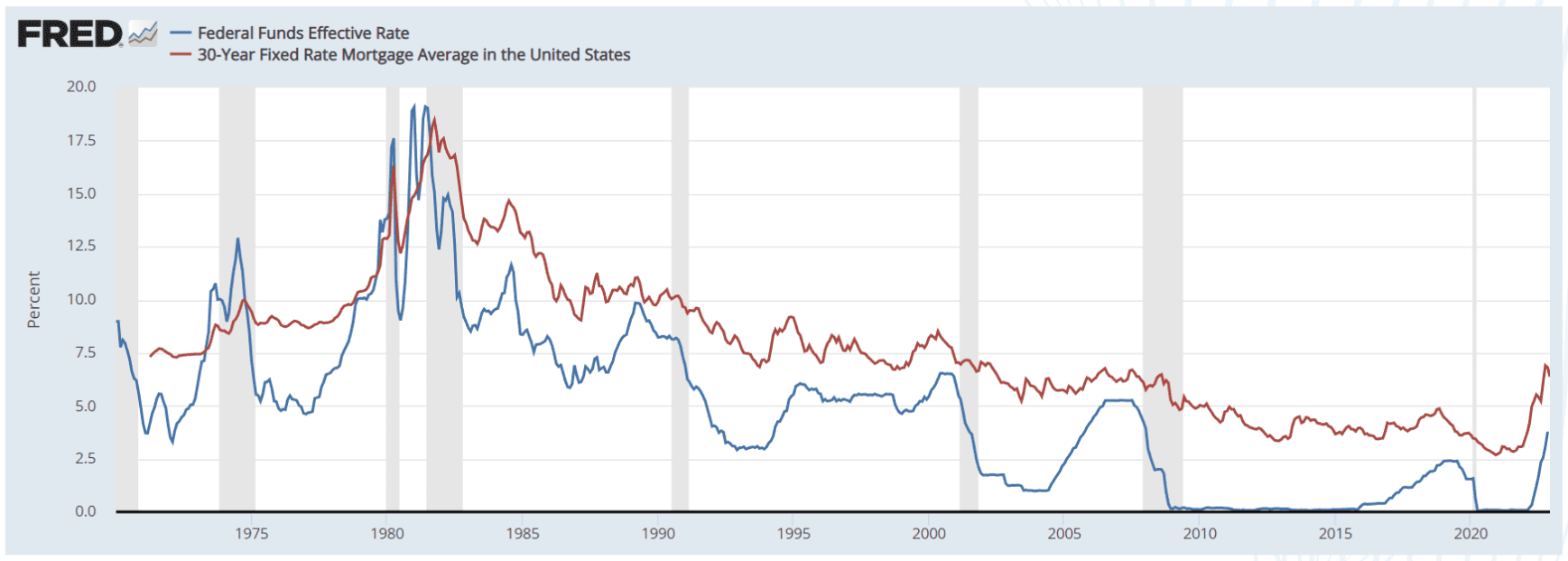

And the other way to look at it is, “we had a good party for 10 plus years, and now it’s time to pay the bill”. That’s pretty much the state we are in right now. So if we look at the interest rates over time, and we’re going to compare that with mortgage rate. So you can see still since the seventies, how they evolve the fed rates.

And so they were around like 7.5% and they went up to 15, 17 and 20% in the eighties during the second oil shock. And then after that they get lowered over time slowly but surely. And we can see after 2008 where they pretty much were artificially kept down, close to zero, they got back up, as I was saying earlier.

In 2015 and then it kind of started to slow down because they could not raise the rates anymore. The market had issues, especially with the US trade with China. And then they started dropping a bit, and then covid happened. And then again, we are seeing kind of this rates being very, extremely low in 2020, 2021, and then suddenly they are going back up again significantly.

The media is saying often, “well, the Fed rates don’t matter to your mortgage rates”. That’s kind of what they’re saying. When in reality, when you look at the data here with the mortgage rates and you overlap that with the Fed rates, you can see there is a very strong correlation. They are pretty much, they’re not in lockstep, but if the fed, if the fed rate is going up, the mortgage is going to go up. If the, if the fed rate is going down, the mortgage rate is going to go down, it’s never going down close to zero, but it reached like 2.65% at the lowest. But it’s still pretty much like a smoothed curve of the Fed rate with a bit of a buffer on top.

And we can see how the numbers on the mortgage rate start to increasing at the same time as the Fed increased their rate. I overlay here the inflation rate just so, people can compare and we can see really how the inflation and the Fed and the mortgage rates are kind of working well together.

They are kind of correlated strongly. We can see that in the past 10, 15 years, the inflation was around 2.5% or something like that. And the, the Fed was pretty good at keeping that. If we look at it, it’s like probably since the 95 or something like that 95, 97, they were able to keep it at around 2%.

But now we are seeing like this, this uptick, which we know about in 2021, 2022 and the mortgage rates, you can see how they’re align perfectly well and kind of the fed rate as well. So kind of all of that are, are extremely correlated.

So just to explain, what’s the relationship between interest rates and mortgage rates.

The Fed controls only the overnight interest rate. What they loan to the bank institution. Aka SOFR, right? And other interest rates of all the durations are impacted from the current overnight interest rates. And this is due to market participations. So we have 1 month, 2 months, 3 months, 12 months, 3 years, 5 years, 10 years, 20 years, 30 years, and so on.

They’re all based on top of the current overnight interest rate defined by the Fed. And the longer the duration, the higher the yield because you’re taking a longer risk. So the yield is higher. However, some rates can be inverted and especially it happens during recession or when we anticipate a recession.

And this is kind of what’s happening right now where the yield that of the, the, the loans that are longer duration are lower than the yield of shorter duration. So this yield inversion is people are anticipating some kind of recession. So SOFR is often based as benchmark for floating debt.

And the 20-30 years interest rate is often used as a benchmark for fixed debt like mortgages and Fannie Mae and Freddie Mac, are providing mortgages rates based on future expectations. So they may overcorrect during uncertainty, which is why we kind of started seeing the things in 2022. So mortgage rates overcorrected in late 2022, when suddenly they started to have 6% rates, mortgage rates 7%, 7.5% mortgage rate, because there was so much uncertainty in the way the Fed was going to increase their rate.

As the uncertainty is resolved that will not be as dramatically higher. The mortgage rates are going to lower again. There is an incentive for Fannie Mae and Freddie Mac to provide mortgages as low as possible. So more people are using the loans.

If nobody is using the loans, there is no value for the economy in which they want to have customers taking loans. So they’re going to try to lower the loans as much as possible. The Fed bought a bunch of mortgage backed securities before to kind of lower the yield on the mortgage rate, but now they stopped in 2022 to fight the inflation and to create a slowdown on the economy.

We do expect that if they want to reduce the rate again, they could buy again those mortgage backed securities. The Fed is currently towards the end of the rate increased path. So they went from 0% to 4.5%. They expect to get around 5 to 5.5% in 2023. We expect the rates to be stable in 2023 and potentially drop in 2024 when the inflation is under control.

If there is a recession. The Fed is going to reduce the rates anyway, because that means if there is a recession, the inflation is going to be under control naturally because people are not going to consume as much, which means that that’s going to bring back the pricing into place and the Fed will not have to increase the rate as much.

So, from that, there is some expectation that mortgage rates are going to be lower in late 2023 and 2024. Question mark here, is it going to happen really or not? We’ll see, but that’s kind of the idea right now.

So the impact of mortgage rates on one to four units in retail housing here.

So that’s mostly the focus here, like homeowners and retail investors. What happened here with the mortgage rates. So let’s take an example. Why mortgage rates matter here. So we have John &Jane, they want to buy a house and due to the current income, they can only afford a $2,000, mortgage per month.

For simplification reason, we are going to assume a 0% down 30 years loan. They have a very good, they just can have everything as a mortgage, no down payment, like to make the math simpler. So in May 2018, the rate at the time was 4.66% and it was one of the highest of the previous seven years at the time.

So John&Jane, can purchase a house that is worth $390,000. So that’s kind of their purchasing power at the time. If we go forward in January, 2021 in the middle of COVID, the rate dropped so much with all of these artificially lowered rates and, and yield that they were able to have a 2.65% and interest rates on their mortgage.

And that meant that for the same $2,000 they could afford a $500,000 house. Much better. Right? And then in December, 2022, which is now the rate now is around 6.5%. While for the same $2,000 per month, they can only afford now a $320,000 house. So we can see here the strong correlation between obviously the mortgage rates and what people can afford.

What’s interesting is like we’ve seen in 2020 and 2021, how the house price got much higher. When one of the reasons was the rates got much lower, which meant that where before John&Jane could only afford a $400,000 house, now they can afford a $500,000 house, and we multiplied that by millions of buyers.

What’s happening is actually the price is going up. Okay. That’s kind of pretty mechanical here is like more buyers at a higher price means that the house price is going to get higher. So now if we look at, the impact of that, so the purchasing power here in January, 2021, that was 500,000. Now, in December, 2022, so almost two years after. It’s 320 for the same $2,000 mortgage. That means that there is going to be less buyers for $500,000 houses, and that’s going to trickle down for all house prices.

That means that the investors or retail homeowners wanted to buy a house at $300,000 and they cannot afford it anymore. Now they’re going do do it at $200,000 houses. So that’s going to kind of create some situation here.

So what to do? Well, so now you have $2,000, mortgage payments and you want to buy a $500,000 house. Well, you can, you can have John and Jane, they could increase income by 56%, right? So instead of paying 2000 per month, they could pay 3000 or something like that.

Honestly, that’s very low probability for that to happen, right? Especially in recession period. Few of them are going to be able to increase their income, but most people are going to have pretty much the same income, or even lose their income because of potential in layoffs and so on, right?

So that’s the very low probability to happen, that they can increase their income. Second probability is that, well, sellers are going to drop the price by 36%. Well, low probability of that to happen as well because if the seller is locked at the low mortgage rate, there is no reason for them to, take a huge loss on the home they just bought and lose all their down payments and everything.

It’s a big impact. So the best is for sellers to wait. They are just going to keep the house stay in their house where they have this low mortgage rate that they got in the past few years. They are going to rent it out if needed or whatever, but they are, there is, there is no incentive for them to sell right away.

They’re better off keeping it. That’s pretty much what’s expected to happen in the future. Less properties available, less buyers because they cannot afford the $500,000 house anymore, but the sellers don’t want to sell it lower than $500,000 houses. And so there is this very tense housing market.

There is still going to be a downward pressure on prices because there is less buyers at 500, right? So naturally the price is going to get lower. But the highest probability is you’re going to keep having this tense housing market, and you’re going to have some small drops in some pockets.

So we’ve seen some cases where in, Arizona, for example, on some other hot markets where the price dropped by 5-10% compared to the top. We don’t expect a redo of 2008, where you’re going to have significant discount on price. It’s going to be a very slow down pressure, and it’s going to be like this very tight market.

Very few buyers, very few sellers, and that’s going to continue like that for a while.

So now let’s look at the impact on mortgage rates, on commercial real estate, which is kind of syndications 506B, 506C, multifamily, industrial, self storages, mobile homes. And this is where, we as investors, invest a lot of our money, and that’s where we have our funds.

So first, how the valuation of commercial real estates, assets is done. It’s based on the NOI, the net operating income, and the cap rate. As a recap, quick recap here. The NOI is just income minus expenses, not accounting for cost of debt. Cap rates is the rate of return the market is going to pay. And it’s going to be between 3 to 10%.

If that’s less risky, less work, it’s going to be in the lower percent of the range, like 3 to 4 to 5%. If there is more work, more risk, the the expected rate of return is going to be 8, 9, 10% or even more than that. You can have some at 15%. So for example, let’s take a multi-family building that has an NOI of $1 million a year.

And the current cap rate right now for that multi-family class is 5%. That pretty much mean that your building can be sold for 20 million. You can find a buyer that is going to buy your multi-family for 20 million because it’s kind of pretty much 1 million divided by 5%.

The buyer is going to invest 20 million. They expect to get 1 million a year as a profit, 5%. That’s kinda how it works. If you want to add leverage here through a loan like a 1:4 leverage that pretty much means a 75% LTV. You get a, a loan at 75%, you’re bringing 25% of the equity to the same $20 million of cash that you had is going now to to buy $80 million asset.

So now, instead of having 1 million profit, for your 5%, now you’re going to have 4 million profit a year. Four times 5%, like 20%, except that with this leverage it’s a loan, it has a cost. It’s that it has a cost. So the actual profit is going to be lower than that once you remove the cost of the debt,

And so a lot of people are saying, “oh, well, you know, when the interest rate got lower, that didn’t really change the cap rate.” Well, there is a relationship as we kind of, we saw the earlier between the fed rates and the mortgage rate and the inflation. There is a similar relation with the debt costs and the cap rate.

The better result that we got recently in the past five to seven years with the multifamily and other real estate assets were because the interest rate for the mortgages got lower, which kind of indirectly lower the cap rate, we can expect that the cap rate is going to react and change if the interest rates on the mortgage is going back up.

So as a seller, when cap rate compress, it’s good for you. Compress means it’s going down. So if you the cap rate that you bought it at 5% and you sell a cap rate at 4%, that means the market is expecting a lower return. You are 20 million, becoming 25 million or something like that. On the other, on the other hand, if the cap rate is expanding, you buy at 5% and you sell at 6%, that pretty much mean that your asset said that you bought a 20 million is probably going to be worth less money down the line.

So if you want to compensate that you are going to have to increase your NOI, your income minus expenses. So optimize the expenses and increase the income.

So in terms of commercial real estate some headwinds and tailwinds the cap rate may expand due to higher cost of debt. As we just talked. The cost of debt is going to impact the cash flow, right? You have to pay more for your debt. That means that it’s less profit in your pocket, right?

If there is a recession, the rent rate and occupancy may drop. It could be just temporary for the time of the recession as people are laid off or they have to merge multiple families together and something like that. But it could be an impact for like few 6 months, 12 months or something like that or more like even 2 years even before it’s back to normal. But fortunately, that part is a mostly temporary.

Now in terms of tailwinds here, we do expect that in 2023 and 2024, the rates are going to stabilize or going to be lower. Because of the strong inflation, we expect the rent to still stay strong or to stay the way they are right now.

And the, the rents have been increasing quite a bit in 2020 and 2021. They may not increase as much as before. It’s not going to fortunately increase by 10-20% every year. It’s not sustainable. But if it stays at the level it is right now, that is going to help your NOI If you are underwriting initially was taking , a lower rent increase into account. The rents it’s expected that it’s going to stay cheaper than mortgage price.

Pretty much that means that a family may decide to either buy a house or they may decide to rent. And if the rent is much cheaper, there is much more chance they’re going to rent instead, which is going to inflate help and keep the, the rent price higher.

Additionally, new housing has been frozen for a long time. So not only after 2008, we didn’t build enough housing in the in 2010’s decade. But when COVID happened in 2020 and 2021, well, everything got frozen, there was no more housing being built or very slowly. And then we are talking about recession risk now and slow down in 2022 and 2023.

A lot of things are not starting. All the home builders stopped buying and building and buying lands and building in new homes and so on. So less housing means that the housing price is going to increase mechanically. So overall, currently the syndications are still delivering, but the jury is out longer term what’s going to be the impact with the debt and so on.

So we, we keep monitoring that.

I had one sponsor sharing some data with me this past week, and I figured it was a good time kind of to show so best of times right now for multifamily in 2022 great returns on some of those sponsors here in Austin, Texas, for example. A lot of it in Texas and Arizona as well. Some in Florida. So we are seeing here the return being between 20 to 30% return per year. Over a short hold of like 1, 2, 3, 4 years. You can see that the buy date is between 17, 19, 18, 20, and 21. But you can see as well that all of those assets got sold in Q1 and Q2 2022. There has been pretty much no sale in Q3 and Q4 of 2022.

Pretty much all the other sponsors now are waiting to see what’s going to happen. So it’s kind of the question is like those returns of 20 to 30% a year are abnormal. They’re not the norm at all. So we should expect that things are not going to be the same moving forward, but it’s kind of something we have to keep track of.

All right. So in terms of the impact of interest rate for syndication, If these syndications invested with long term fixed rates that’s really the best case here. If the rate has been locked for a long period of time, 5-10 years, something like that, then they can withstand the storm and everything.

But what will happen when the buyer tries to buy the assets, when the sponsors wants to sell their assets, it’s like, well, the financing for the buyer is going to be quite different, right? The rate may be higher for them. That means that’s going to impact the cap rate and so on. So even if that’s the best rate to, to withstand the storm, that means at some point when you want to sell, the return may or may not be the same as what was expected.

For shorter term floating rate, this is a bit different. We are seeing quite a few sponsors had floating rates, and the question is, do they have some rate caps in place? And I will explain to what the rate caps are after in detail, but pretty much is kind of how to make sure that there is protection against rising rates.

If there are some extensions on these rate caps, how many? What was the cost? What is the cost? If there was no rate caps, this is a big red flag, here. That pretty much means that when the rates increase significantly, the sponsor got caught their pants down and they have to pay the full price of the debt increase and their debt service coverage ratio, which is how much money they have after paying the debt may start to be below 1.

1 means all your income is going to pay the debt. You’re not making any profit or whatever. You’re not making any cash flow. You’re just paying the debt. When you are way above 1, this is great. You’re making a lot of profit. your debt is not a big portion of your income.

When you are below 1, that means you’re pretty much losing money every month in terms of your cash flow, and you’re going to have to put some money at some point if you want to keep the property, because the debt is costing you more than the income you’re making from the assets.

So if it has some rate caps. Then it may be okay, but you’re not out of the woods because what’s going to happen when you have to renew your, your rate cap in 2023 and 2024 and then next year, well, the rate caps are going to be more expensive, and during uncertainty and raising rates that may be very costly to keep those things.

So again, the debt cost is going to have a high impact on cash flow of the property, right? It’s going to directly impact that, which is going to impact the profit on the property and you cap rate down the line. Now, in terms of floating rates , more example here in term of the rate caps.

So the secure overnight financing rate, which is kind of what is defined by the Fed. It’s currently at 4.32% in December, 2022 while it was 0.05% last year. So it’s a big increase here. You can see that, for example what was negotiated for some sponsors is a spread of 2.5%. What it means is your all in rates is the SOFR plus 2.5%, which means that current rate, right now, for your property is 6.82%. But the sponsor may have bought some rate cap here, right? This 2%. This is, they are, they make sure that they will not just being tied to the, the fed rate, they will cap that at most, so at most 2%. So you all-in rate in this case, In this example will be your strike rate capital plus a spread.

So these 2%, at most, not the 4.3%, but the 2% at most, plus a spread 2.5%, that’s 4.5%. It’s not that bad as bad, right? The 4.5% is better than 6.8%, but when you are going to have to renew those rate caps are usually a few years. When you have to renew your rate caps in 2023 and 2024, things are going to be quite different.

So that’s a concern here. SOFR is one of the main benchmark. The other one is the LIBOR, London Interbank Rate. I’m seeing pretty much half, half in term of the loans being indexed in one or the other. SOFR is going to be specific to the US. LIBOR is going to be more like kind of a global rate, which is, doesn’t move as quickly as the Fed rate.

So some final thoughts here. So we should expect that 2023 to be a volatile year for bond, stock market and real estate assets. That’s still going to be the case here. We have three years now. 2020, 2021, 2022. Very volatile, very complex environment. We should expect 2023 to be the same. We should expect that 2024 for things being calmed down for the bonds stock market probably, but it’ll still be volatile for commercial Real Estate as loans have to be renewed. A lot of the loans after like three to five years, Sponsors, they’re not buying loans. 10 to 30 years or whatever. Just, just try to keep the duration as small as possible so you don’t have to pay much of penalty of prepayment. So things to watch out for is when you invest in a syndication, for example, you do not want to have the same underwriting, you don’t want to have the same cap rate as in 2020 and 2021. Things are very different now, so it should be more conservative there. And the same way the exit cap rate has to be more conservative than before, which means you really have to take in account that the cap rate should be higher than the entry cap rates by 1% around 1% or something like that, or even higher. Even the higher, the better. You don’t want to invest in a deal, where there is a high LTV, 80% and above, you want to target 60, 70%. The lower your, your LTV, the lower the risk and the lower debt cost as well. Other things is diversify, diversify, diversify.

It’s really, you cannot be tied to one specific sponsor or one specific asset class, like multifamily. You want to diversify across multiple sponsors, multiple asset classes like self storages, mobile homes, for example, some of the industrial and whatnot. And then you need to make sure that all you loan environments are bit different, right?

Not all tied exactly the same way. And the more you’re going to have deals from different sponsors, different asset classes, you are going to have different terms, which mean that it’s going to help you withstand all of this storm here with interest rates. You don’t want to keep it all your money in one single sponsor that happened to have taken a bunch of floating debt. With very little rate caps and then ending with a very high debt cost in 2023, 2024, and you ending up losing a lot of money.

So for example, if you feel you’re not comfortable with the current investments, you may want to invest in debt instead of equity. Debt is going to be much safer.

Equity is going to be the first one to lose money. You are going to have a better situation like that. Finally, market is challenging, but there is always some opportunities when you are ready. So you have to be ready to add when time is right. And kind of what Warren Buffet said multiple times, be fearful when others are greedy, which was in the 20 18 and 2019 period.

And even late 2021, I would argue and you want to be greedy when others are fearful. Things are scary right now, but you are going to find some good assets if you are looking closely. So that’s one of the key thing to keep in mind, it’s always a time to invest. You just have to find the right asset at the right price and not being too greedy.

Okay, so I’m going to take questions now. I’m going to go through the chat. If you have more questions about this presentation, sorry, I’m going very fast here. There is a lot of content but if you have questions, feel free to shoot us an email to myself, Saikrishna, or Jeff.

(Q&A portion – replay skipped for brievity)

All right so we’re going to wrap up. Thank you everyone for joining. Again we have here the emails. If you have any question about the content of this presentation, feel free to reach out to us and we’ll answer your questions. Alright.

Thank you everyone. Bye-bye.