Here is a webinar we did in January 2023 sharing our Fund Updates (Income and Growth Funds).

Transcript:

Welcome to our January 2023 webinar. We’re going to talk about updates on our various fund investments.

So quick intro about ourselves. I’m Olivier. We are part of Lazuli Capital, and we are building funds for accredited investors to join our various US real estate investments with Saikrishna and Jeff.

We are going to answer your questions toward the end. We can put all your questions in the chat on the Zoom box. We’ll go through it. There is a lot of content, so I’m going to go very quickly on it and answer all the questions at the end. That’s probably the best.

So very quick recap on what a capital stack is. So we have the senior debt, mezzanine debt, preferred equity, and equity on top. So the senior debt is considered, kind of, the safest investment in the capital stack. And that’s when you invest in real estate; usually, you have a loan involved, and that’s where the senior debt is, and it has the lowest return as you go higher the stack, you are after the senior debt, so mezzanine debt, for example, is coming after the senior debt, is going to have more risk than senior debt. Senior debt is going to be the first one to be paid, so it’s gonna be the safest, but it’s going to have the lowest return. Mezzanine debt is going to be a bit riskier, it’s going to have a higher return. Preferred equity is going to be even more riskier and has higher returns. And the highest return is equity. Let’s say, for example, you have a 20% equity stack. That means that if the market price of the full real estate drops by 20%, that means your whole equity is going to be nulled. So that’s kind of the thing where you have the highest risk and the highest return as well. The risk and return go hand in hand because if you have the highest risk, the market is going to ask you for a higher return as well. And our investments are going through senior debt, mezzanine debt, preferred equity, and equity through all of our investments.

So first, I’m gonna talk quickly about the income fund. The income fund was created in July 2022. It’s open for investments. The focus is on debt and preferred equity.

So as part of the capital stack I talked about earlier, it’s the bottom half, the target is above 8% net IRR, and it’s a 506C, so it’s only for accredited investors.

What does it mean in terms of the overall risk profile? Right now, we have only one investment. It’s 100% in preferred equity.

The LTV on the whole fund is currently at 65%. We do have a buffer against losses. That means the equity above the preferred equity is the buffer. The equity is going to be wiped out before we get losses on this fund. The hold is around 2+ years. The target IRR is 12% for the fund.

And so, there is no expected fair market value increase quarter to quarter, but we expect to have 3% distributed quarterly, 2 to 3%.

So right now, that’s the investment we have 100% in preferred equity. So it’s a small multi-family in New Hampshire. The target IRR is 12%. That’s currently giving, giving us 9 to 10% net to the LPs.

The hold is one to two years. The LTV is 65%. The loan terms are nice at 4.75 to 4.85% fixed for five years. So this is a multi-family, small multi-family fund. They have three properties there, between four to 12 units. The remodel is performing as expected. We are receiving a 3% distribution per quarter. Everything is going fine there.

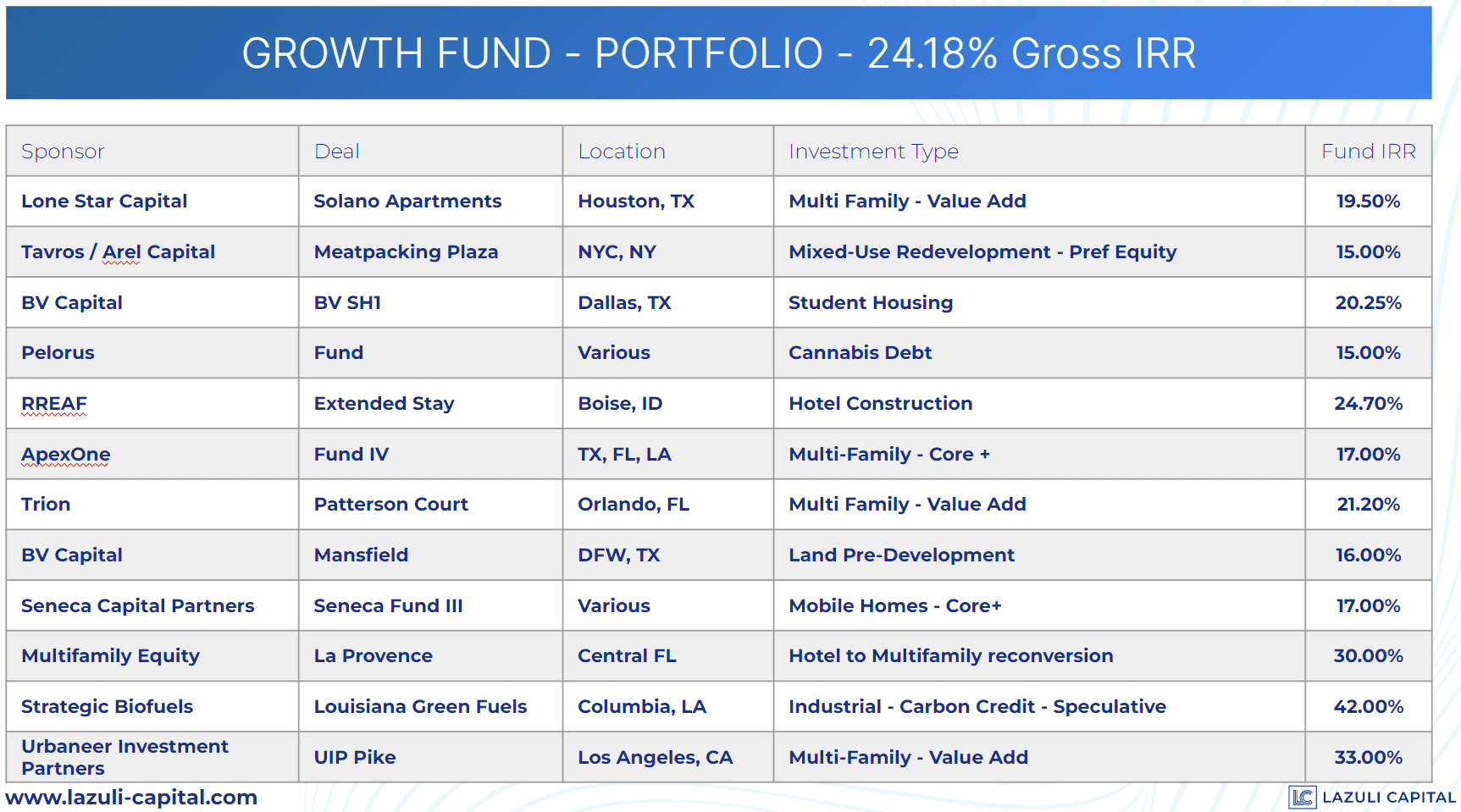

Now, I’m going to talk about the Lazuli Capital Growth Fund. So, the fund was created in June 2021. It’s closed to new investments. We made the last investment this week. We made the wire. It’s a balanced mix. It’s tilted towards growth.

The target for the fund is 13% to 15% net IRR, again a 506C for accredited investors.

So here is the composition for the growth fund. We have 17 assets, and multifamily is almost 32%. Then after that, we have short-term rental at 20%, 10% of speculative. We have 8% on RV camp, 4% in debt, vertical development land, NNN retail, a bit of mobile homes, student housing, and a bit of preferred equity last.

To note, in early 2022, we were at 60% multifamily, and we tried to reduce our exposure to multifamily because the rent growth was going too fast and too high. An increase of 10% year over year is not very healthy. So we wanted kind of to remove some of the risks specifically tied to multifamily.

Additionally, there was a lot of cap rate compression, so there were not that many good deals anymore, in multifamily or safer deals. So we wanted to avoid being overexposed to multifamily. So we are now, multifamily is less than 32% of the fund, so it’s much healthier. We replace that with a mix of different other investments like NNN, short-term rentals, some speculative, and RV Camps.

So that’s the overall risk profile for the fund. We have, like for the income fund, we do have some debt and preferred equity. But we do have some core and core plus, value add, vertical dev, and speculative investments as well. The LTV is roughly 70% overall weighted for the whole fund.

The overall weighted average hold is 3.5 years, some are expected to be held for one year or less, or two years. Some of them are going to be five to seven years, but overall the average is 3.5. The current gross target IRR is 24.18%. And right now, we have a quarterly FMV increase of 2.82% on average.

So right now, the risk score is like 4.6, which is roughly between the core plus and value add. So the income fund was mostly, was only in debt and preferred equity, like 1 and 2 here as a factor. So here we are much more aggressive with a much higher return.

So what does it mean with 24.18% as a gross target IRR when we are saying it’s only 2.82% per quarter? If you do 2.82% per quarter and you do that every quarter, you’re going to arrive around 11-12-13% and not 24%. It’s because we are doing the Fair Market Value conservatively.

And so that’s based on depending of the category of the investments. If that’s debt, we take 100% of the target. If, for example, the debt investment is expected to return 12%, we put that at 12% as part of the growth of that particular asset.

If that was preferred equity, we would take 66% of the target. So if the preferred equity was expected to return 15%, we put up the fair market value update of 10% a year. So that would be a much lower return per quarter.

The equity here, we’re taking 50% of the target. That means that if the target for the equity was 20%, we put a fair market value update per year at 10%. If that was speculative, it’s like 33%. So we are assuming that because it’s conservative, we are assuming that it’s a high risk, high return. So there is a big chance going to not pan out as expected. So that’s why it’s one-third of the final target.

So if that was a 30% target, that means that the fair market value updates are 10% every year. So that’s why you get to this 5.54% per quarter, which is like if you compound that every quarter, you will get 24.18%. Well, it ends up being 2.82% per quarter when you apply every single of these factors, these conservative factors for debt, preferred equity, equity, and speculative.

So pretty much that means that if things are going well then, and to plan, the fund is going to have this 24.18% as target IRR, gross target IRR and is going to realize that. But the Fair Market Value is going to grow much lower than that. It’s going to grow at 11%- 12% or something like that per year.

So there is a gap between what the Fair Market Value is and the actual value. And so if there is some underperformance, the gap is going to be smaller. On the downside, the target IRR is going to be closer to the Fair Market Value. If things are going according to plan, then the Fair Market Value is then going to increase toward the target IRR.

And on top of that, each syndication may be adjusted depending on performance, depending on expectations, and so on. So every quarter, we review every single of our investments, and we revisit the numbers and their valuation on top of conservative factors.

So that’s the overall FMV performance here. If we made the first investments in Q2 2021, we would invest $50,000. And we can see every single quarter what the growth was in terms of Fair Market Value. As we are growing the portfolio, we made a lot of investments. We made 17 investments in the meantime, so a lot of things have changed.

So depending on each quarter, I think we are right now at 2.36% quarter to quarter. 15% return since inception. That’s after expenses, after the 0.5% AUM fee. And assuming no carry right now. We have a big distribution for this quarter of 4.30%, which has been reinvested directly for a new investment, which is an event venue. I’ll talk about that later.

(Question:) I’m wondering how you calculate the FMV? (Answer:) Yeah, the FMV, that’s based on investments made in Q2 2021. I’ve got an investor that invested, and I keep track of the growth that happened during that time. So I keep that, I keep track of that in parallel with all the current investors.

So here are some of the investments we have right now. So that’s the first half. I’m not going to go through them in this slide because we are going to go into more detail after, but you can look at them during the replay.

That’s the second half. One note here is the Bayou Bridge Capital Fund. We invested back in, I think, if I remember correctly, in June-July 2022 initially. The fund did not pan out. They ended up closing the fund because of their first investment, because of the current economic crisis, they wouldn’t be able to do the purchase, so they ended up refunding their own money.

So, with the money that we had, a return from Bridge Capital Fund 1, we invested in the Grand, which is an event catering and hospitality.

So in terms of the Growth fund, it’s kind of a recap of the previous webinar from December. Headwinds: there is a potential impact from increased mortgage rates, and we’re going to talk through that for each investment. What can be the impact here?

Because the mortgage rates increase with what the Fed did in 2022. There is a potential for cap rate expansion. Increase the cap rate, which is going to lower the value of the assets. There is a risk of recession as well. Every week is different. Some weeks, like, “Oh, the recession is guaranteed”. “Oh, maybe not”. , this week that was like, “Oh, maybe there is no recession”. We don’t know. But the impact, if there is a recession, there could be a decreased occupancy, and with decreased occupancy, meaning that you have less income coming from the rent.

As tailwinds, we have higher inflation, which means increased rent. We’ve seen that a lot in 2020, 2021, and 2022. So that increases the income coming from the assets.

We do expect mortgage rate stabilization. The Fed is not going to increase their rate as much now and potentially lower them in late 2023 or 2024, so that could help a bit on the mortgage rates. Currently, as a tailwind, the rents are still cheaper than mortgages. So there is still a lot of interest and a lot of value for families to just rent instead of buying a house because it’s very difficult.

Houses right now are very unaffordable. Additionally, because of what happened in 2008 and 2009, and then what happened with Covid and now with recession talks, there is limited new housing still. So there is still a restriction in terms of how much new housing is being built, which means that’s going to create pressure on the current rents.

So let’s go through the investments now. So we’re going to go through the most conservative to the more aggressive ones. So let’s start first with the Pelorus fund. We invested in July, 2021. It’s a debt for the cannabis industrial, so that’s putting money into cannabis farms, cannabis retail, and a lot of the other related investments. The location is all over the US. I think they have around 50 ish, 50 to 70 loans, something like that. The target IRR is 12% to 15%. It was 15% in 2020-2021. It got lowered in 2022. It’s around 12% ish now, 11% to 12%. They still expect to get back to 15%. They had a lot of cash drag in 2022, so we expect it’s going to be a bit better.

The hold is 1+ years. The LTV is 61%. So it’s a bit misleading here because the LTV they are providing the senior loan to those various companies because of Federal laws. Banks cannot lend money to cannabis farms and order cannabis-related businesses. So, the Pelorus fund does provide those loans to those cannabis-related businesses.

And so here, 61% is the size of the senior debt owned by Pelorus Fund, and there is 39% or 40% of equity on top. The loan terms here are not applicable here because we are not, there is no additional loan on top of what Perus Fund is, is providing. So again, as I talked about earlier, the yield dropped and stabilized around 12% there is less cash drag. So we expect the yield to get higher over time. But it’s probably not going to go back to where it was at 15%. There are some concerns about the Federal laws that could be changed to allow cannabis businesses to raise money from banks and so on if it’s legalized.

But right now, it has been stalled, like five or six times in the past 5 to 10 years. We do expect, with the current situation in the market and in the Congress and Senate, that things are going to be like that for at least two or three years. So if banks start competing, that will mean that the target IRR will drop. There will be a lower yield, but right now, as long as things are getting stalled, then the rate will be pretty much the same.

Then we have the next investment we made in June 2021. It’s one of the first ones that we made. So that’s Tavros / Arel Capital. It’s in New York. Very close to some Google offices. It’s a preferred equity for mixed-use. There is, I think there was like 20% buffer on top of this investment.

The target IRR is 15%. The hold was two years. So we do expect an exit. I mean, that was expected at the time. There was going to be an exit in December. But there are some extensions, 6 + 7 months extension. The LTV is 60%. The loan terms are like 3 years. So even if they held longer than the two years, it’d be fine.

The project’s progressing but slower than expected for multiple reasons. Obviously, with Covid, the cost of making the remodel plus having all the parts and everything. But our investment is senior to the sponsor equity. So the sponsor has a lot of equity above us. So we do have a fixed return, and we have priority in terms of getting our return back. And we have a 2.08% of the fund invested in here.

Then we go to another preferred equity here, which is a bridge loan for NNN. So it’s in Sacramento. The target IRR is 15% to 20%. It’s 20% per year, but 15% if held for less than a year. The LTV is 76%. The financing is assumed from the builder. They’re getting refinanced.

I talked to the sponsor, and the investors’ relations was sick this week, so he couldn’t give me the exact loan terms. That’s the same for the 3 BV Capital investments we have. So we’ll see that as well for two others. But I’ll have the exact data tomorrow.

But pretty much, it’s a NNN healthcare tenant with a 20-year lease is moving in, has moved in already. So the Sacramento Neuro Inpatient Rehab Facility. Everything is going well there. The entry cap is 6.42% which is nice for NNN, and there is a 7% buffer against losses that the sponsor put as equity. We are, again, we are preferred equity. So we have, we are safer than the equity. And the target IRR again is 15% to 20%. So that was a very interesting deal for a short play of less than a year. And if, if that lasts longer, it’s a NNN that is going to bring good cash.

Then we go to the core category here at 4% investment. It’s in Rochester. The investment was in May 2022. It’s retail. So it’s quite different here compared to the rest. The hold is 5 years. LTV 65%, good loan terms, five years, 3.75% fixed, and there is a guarantee on top of it from the Marcus Family Office. It’s performing better than expected.

They are looking to even sell some parcels at an attractive price. They did have some previous tenants that left before the close, it was known. It was part of the purchasing price that some of the tenants left, and they had to be replaced. So now, they’re trying to get that replaced.

That’s why there is 60% leased by now and 40% vacant, and all the numbers were assuming that the things we’re going to stay vacant. If they can lease that, that’s going to bring more income and increase the return. The expected exit cap rate is 8.4%, so that’s good. Even in this higher interest rate model.

There is a cinema there. So that was kind of one of the bigger risks for this specific asset. By the way, Marcus Family Office is part of the Marcus brand, and Marcus is a big movie theater company. They are trying to sell the movie theater to another company.

If they did that, that would mean a significant de-risking of the project. Because of Covid and the changes in the behavior of the customers, the movie theater is probably not the best asset to invest in moving forward. But regardless, the terms were very good for that asset to join.

All right, so we go now to the Core+ category. Apex One is one of the top-tier sponsors in the industry, in the multifamily. We invested in September 2021. So it’s investing in class A and Class B multifamily. Some of them that are remodeled, and some of them that are to be built.

It’s in the South-East: Texas, Florida, and Louisiana. Target IRR is 17% with a hold of five years, and the LTV is 65%. The thing, though, that is interesting is like most of the loan terms are Floating Rates. So even if you have a very good sponsor, you can still be in a situation where the loan rates you join are not always great.

And things were fine back in September 2021. But we can see that things have changed completely from one year to the next. So now there are some concerns in terms of their loans. They have some Rate Caps, they did some stress testing with the current rates, and so on. They are still going to deliver, but they may not have the same performance that they were expecting.

So, we are going to check what’s the impact of that for the floating rates in late 2023 and late 2024. Depending on what the mortgage rate is going to be, then. But in the meantime, they have 94% occupancy. Due to inflation, as I talked about earlier, the rent is 16% above proforma. So that’s great. 18 properties, 14 are stabilized, and one is getting leased. And we have three developments of three more properties that are going to bring some income later.

Then another investment we’re making in Core+ is Seneca Capital Partners Fund III. We joined in August 2022, so that’s an investment type in mobile homes in a bunch of different states. The target IRR is 17% with a hold of 5 years. LTV 65%, so still healthy. The loan term is indexed on the 10 years Treasury Debt.

Which impacted the cash flow because the debt increased significantly in the past year. So that’s, again, a very good sponsor. But they just like using floating debt. The past year has not been great for those sponsors. Because they have a hard time finding good deals, only 32% of the capital calls have been made.

So we have around 70% of the cash, then, ready that we are waiting for them to call us on the rest. But again, the rent increased, so that generates healthy cash flow. So we’ll see how it goes, and we’ll see how it pans out. So currently, it’s a 2% of the fund invested in mobile homes.

Once this sponsor finds good deals, and they invest in it, and we have the 70% capital calls being made, then that’s going to significantly increase our investment from 2% to 5% of the fund.

Then we go to the second BV capital deal, with Student Housing 1. It’s in Dallas, Texas. It’s on two different multi-family, I mean, it’s like student housing, but it’s like, it behaves almost like as a multi-family, right? It’s a bit different target here because the multi-family, you have the family staying the whole year, and you have regularly people moving in and moving out every, every month where student housing is based mostly, well, on the student year.

All the students are coming in the fall, and they leave before summer. And so, all the metrics are a bit different here, but you can increase the rates for the rent a bit higher if there is not many competing housing in the area. The target IRR is 20%, five years, and LTV at 71%.

Again, as I said earlier, we are waiting for the info from sponsors in terms of loan terms. I know it’s a floating rate because they indicated that their debt cost was higher in the past year compared to where it was a year ago. We joined in July 2021, but the remodel of the units is done for this year, for this school year 2023. They are doing the finishing touches for the outside. It’s performing as expected. So they have two different student housings. So one of them is 100% leased, and the other is 92% leased. In both of them, they have significant rental increases compared to the year before.

So it’s going well, so far. It’s only 2% of the fund invested in this value-add deal. But again, we keep monitoring that with the floating rates.

Lone Star Capital, a great sponsor of multi-family here that we invested in June 2021. Value add here. Multi-family in Houston, Texas, a target is 19.5%, 5 years hold, LTV 75%. 4 years interest only based on the SOFR (Secured Overnight Financing Rate) plus 2.44% with a 3.72% cap right now on SOFR, which obviously they need because they are over the cap.

SOFR is over the cap now. So the good news is they have a higher NOI than planned, but the CapEx and debt, as we talked about, are higher, though, because they are based on SOFR. So they have a 95% occupancy. Remodeling is going well as planned. Everything is good, but distributions have been paused for a few quarters to build reserves.

A lot of the lenders are asking to build reserves just in case the rates are going to get higher. But right now, they have a 4 years loan term, so that’s good. We can see how things are going to be in late 2023 and 2024 but expect to restart distributions in the next few quarters.

As we see, even good sponsors have been caught with this debt cost increase.

Trion – Patterson Court, that we joined in October 2021. Another Value-Add here, is multi-family class A in Orlando, just by Walt Disney World. There, just pretty much in front of Walt Disney. Target IRR is 21%. Hold of 4 years. LTV 72%. Again, floating debt with a cap. 3+1+1 interest only.

So, this asset was interesting. The big property is a class A/class A+, like a resort-style multi-family. It was a NNN master lease to Walt Disney World until April 2023. So that means that for the past 18 months, Trion bought the property from Walt Disney and leased it back to Walt Disney for 18 months.

And starting April 2023. Now, Trion is going to manage completely and is going to be able to do the remodel of the full units and convert that to full multifamily. And so they want to remodel to generate more income. Again, concerns about the floating rate here, but they do expect to have a significant rent increase because back in 2021, the rents were not as high, and they raised since, and they’re going to have new tenants coming, and so on, they’re going to significantly raise the rent compared to what Walt Disney World was paying.

Another value-add multifamily here. It’s a Class C in Central Florida. It’s one hour south from Orlando and one hour from Tampa. The target IRR is 30%. The sponsor underwrote 42%, but we put it more conservatively at 30%. The hold is three years. LTV 70%. The loan terms are 3 years and 7.99% fixed. They were high at the time when we joined in February 2022. But now, given the market, they are kind of, they are acceptable. Obviously, after three years, we have to refinance.

So this is the case where we joined this investment because the asset was very good, but there were some concerns about the sponsor, and we still have some concerns about the sponsor, but that’s why we reduced the target IRR.

But the asset was very good. And so, if the remodel did not work out as planned, we could sell back to the same amount or, with a big profit anyway, to some other sponsor. The remodel is slow. There is a cost overrun, there were some issues about a major capital call, and some of it could still happen, but we’ve been pushing back.

So there was no capital call on that. Again, the asset was acquired at a very low price. The owner, the previous owner was like 92 years old, and they wanted to get rid of the property, they could not handle it anymore, and it was old property. And so that was very good assets bought at a very small price.

So, with a bit of difference here in this asset in terms of the waterfall, is that we are bought out once we reach 42% IRR. That means that, as long as the investment doesn’t reach 42% IRR, we have full equity with the full normal waterfall with pretty much 100% of the profit.

But if it reaches 42%, then we are going to get bought out, and the sponsor is taking all the upside after that. So that’s kind of a different risk profile here. But again, very good assets, the sponsor, we are monitoring that, and we’re talking to them regularly.

(Question:) So, Olivier, what is the current occupancy rate? (Answer:) They’re still remodeling right now. They’re still, so there is no occupancy. They sent me some updates yesterday night. I didn’t have the time to look at it in detail yet. That’s 4.45% of the fund is on this asset.

All right, so the next one is Urbaneer Investment Partners.

UIP Pike, we joined in March 2022. That’s a Value-Add. 11% of the fund is on that investment. It’s in Long Beach, close to LA, multi-family class B, value add. Target IRR 33%. Hold 2 years. LTV 74%. Loan terms: 2 years plus 3 six-month extensions. It’s a fixed rate right now, so that’s great at 6.75%, which is a bit high for a fixed rate at the time, but at the same time, it’s for a major remodel, and it’s very hard to get loans at the good terms for these kinds of remodels.

So that’s two properties in Long Beach, with each around eight to 10 units. The remodel is going according to plan. They have some move-ins already. The rental market has been stronger than planned. That’s great. There was some ADU, some units they were building behind the property to add some additional income. That’s being slowed down due to the city’s staffing. They don’t have the permits right now. Both of them have one ADU in each property, and that has been slowed down. So that’s probably going to take a bit longer. But in the meantime, we have some moving. So we’re going to start to see some income from that investment.

And this represents 11% of the fund.

Another value add is Happy Camper Capital, here. Elsen’s Little Farm that we joined in April 2022. It’s an RV camp. So the funny thing about RV Camp: one year ago, it would be very hard to hear about RV Camp. There were pretty much no offers. Now, I’m receiving an RV camp offering almost once a week now.

So things have changed quite a bit, which is good for this investment because we joined very early in the wave. It is going to give us a lot of potential exits down the line. So it’s in the Ohio River in Indiana. 23% IRR targeted. The hold is 4 years. LTV 70%.

Five years interest only at 5.35% fixed. So that’s great terms here for the loan. Things are going on track. They’re preparing for the 2023 season. It’s going to be spring soon, so things are going to be great there. They acquired a beer and wine license for the property to begin liquor sales in 2023, so that’s great.

They added some dog parks. They are making various improvements. They bought some golf carts for people to rent just to generate a bunch of income. We had an entry cap rate of around 8% if I remember correctly. But because now there are so much more demands now for RV camps, there is gonna be some compression to 7%, 6%, something like that. As it is a more established class, so that’s gonna be great for these investments moving forward. We have 8% of the fund on this value add RV Camp.

(Question:) So, Olivier, can I ask a question on that RV park, if we could go back? Yep. Do you see this thing, this particular asset type performing better in these current conditions? Yeah. Probably more accessibility. (Answer:) Yeah, so I, I think the way I look at it, so there are like two classes that are known to be recession resistant. Yes, there are self-storages and mobile homes. That’s how they have been targeted for years, and they’re doing okay during a recession, sometimes better, but not always great, but they’re doing okay. I believe that when you compare RV Camp versus AirBnB. That RV camp will be more recession-resistant and would do better during a recession than AirBnB because usually, it’s simply cheaper if, even if you just do tents or something like that. So I think from that point of view, this is going to go well regardless of the market, and it’s going to hold better during a recession.

So here, we’re going with the vertical development. RREAF, Extended Stay Investment in August 2021, in Boise, Idaho. Target IRR is 24.70%, and I put here the new underwriting to be 33%. The LTV, and I’m gonna talk a bit about that in more detail. The LTV went from 65% to 85%. Here is what happened.

We invested in August 2021, and we reached out to the sponsor multiple times for six months. Nothing pretty much happened. They were still negotiating the construction back at the time. If you remember, it was still COVID. A lot of issues with getting the labor in place and the materials, so construction.

Then there were issues having some loans, and so for six months, pretty much nothing happened. And then, they get a new loan after six months, finally, where they can start the construction. But the new loan had higher leverage than expected. We were interested in joining here at 24%, our target IRR, because the LTV was at 65%, but then they cannot change the terms six months after.

So, they are saying that the target IRR now is 33%. I am keeping it as a fund at 24%. So, we’ll see how that performs. There is like higher return expected but more risk as well. The loan term is 3 years at 10.5% fixed, which is normal, relatively normal for full construction. But the construction is now moving along.

They are still expecting to be roughly on time. At least, we have 3 years after, when was it? January 2022, something like that. So, we still have 2 more years. We should expect that even if there are some issues when the hotel is built, we can refinance more easily than we could do right now.

So it’s a vertical development, meaning we are building the hotel from scratch, from the land. Usually, I am not investing in hotels. The only reason Extended Stay is okay is because it’s a bit different from a hotel. It’s like more cash flow. You invest less in the business and more in terms of cash flow.

It’s not like a Hilton, Hyatt, or something like that, which is going to be more like a business. And if you mess up on your management structure, you are going to have some high risk. Plenty of people lost money in hotels in the past five years. I mean, especially obviously with COVID, but even before COVID, there were already some issues because if your business is not performing well, you are going to have a lot of issues on the cash flow and the occupancy. But Extended Stay is different. There is barely any management if you ever stayed in Extended Stay.

It’s a 4.5% investment for the fund. We’re keeping track of what’s going on here, making sure that everything is going fine. But right now, the construction is moving at a good pace. Still obviously a six-month delay.

So the third BV Capital Investment, we have. Again, we don’t have the loan terms. I should have them tomorrow. So that’s a bit different here. It’s Manfield. We joined in December 2021. I think the closing was in January or February. It’s a land predevelopment and a short-term investment.

So in the previous one, we had the land, and we were building the hotel from scratch. Here, that’s the phase before that. That’s the phase where you do buy just the raw land, and you put it in a way that you can build something on top of that. So we’re in phase one here. Which is like, we buy the raw land, and it’s 20% preferred return, 12% minimum if the hold was less than nine months.

So that’s a 9 to 12 months hold here. The LTV is 55%. So it is going on track. So the current phase is like preparing the plans for the drawing with design and architects for the multi-family. And the idea is that at the end of this investment, they are going to raise capital from other investors to build the vertical development of this multifamily.

At that point, we may decide to join that vertical development or not. If the terms are okay for us, we’ll see. So we have the option to join the next phase in Q1-Q2 2023. So again, it’ll depend on the terms, but right now, it’s mostly validation with the construction team, planning, drawings, and so on. So things are going to plan right now. Things are going well. We’re keeping track of that.

It’s a small investment for the short term. Normally, I would expect that we’re going to exit this year. There’s going to be like one of the few that are going to exit this year. The fund invested 4% in this land predevelopment.

Now we’re going to the speculative investments. So here, strategic biofuels. The deal is Louisiana Green Fuel, that we joined in March 2022. We have 4% of the fund in this speculative investment. Very different compared to everything else we talked about. This is an Industrial Carbon Credit plant. This is really what you hear about Carbon Credit sequestration, one. And the other is from the farm industry and building some biofuel from that.

So that’s all you hear about the news, and so. All these green energies and whatnot. This, this is it. It’s very speculative. It’s like, think of it as a startup investment here. That’s why it’s part of a speculative play here. It’s in Columbia, Louisiana. Target IRR is 37% to 42%.

It’s a long-term hold, 7 to 10 years. Everything is a loan, so we are coming as equity, as a startup equity, if you want, with an LTV of 100%. And the loan terms, they don’t apply here too much. It’s like they’re all coming from the states and federal loans, Louisiana and the Fed may give some loan to that company, plus capital raise.

So the project is going on track. We are at gate 2 right now. One of the largest investors in renewable fuel projects in the world is moving forward, and they want to commit 100% of the capital raise and the loans. They’re talking about the FEL three, which is a $55 million to $60 million commitment, and then the $600 million commitment after.

This whole project is pretty much $1 billion. That’s kind of the order of magnitude we’re talking about here. We invested 4% of our fund in this speculative investment, and the fund has up to 10% of the investments in a speculative play, high risk, high return. So if these largest investors in the world in renewable fuel projects invest here, this will validate the viability of the whole project.

And it’ll significantly de-risk the financing. Because at that point, you have as much financing as you need. But as long as we’re not touching Gate 5, which is the thing is built and it’s really commercially viable and so on, and then we get a lot of income out of that, there is still some risk.

So we’re not out of the woods here yet. I think it’s like 3 to 5 years before we get big cash flow, but when we’re talking cash flow here, we’re talking about 100% of investments coming as cash flow every year, pretty much something like that.

All right. The next speculative investment and last investment we made, we made that investment this week. We did a wire early on Monday. It’s a hospitality Event Venue in Baltimore. The target is 30% IRR, it’s underwritten at 45%. It’s a hold of 5 years, and I’ll talk about why it’s 45% underwritten here. LTV 65%. Loan terms: 5 years long. 18 months, interest only based on SOFR plus 2.75%. There is no Rate Cap that I’m aware of. But given how SOFR is going to be, it’s going to stay around the same or get lower over time. Now that inflation is going under control, it’s less of an issue.

The story is that this Event Venue got closed during COVID. As we all know, in March 2020, the world stopped, and everything closed.

Everything, even the hotels and obviously Event Venues, was the first to close. And now, finally, it’s reopening. In the past 6 months, they have been opened. So they are looking to get the pre-COVID revenue within five years. So they’re starting from scratch and rebuilding the whole business.

So this 45% is based on they can get to the pre covid revenue within five years. Not a crazy target. And the reason we put 30% here as target is just because we kind of trying to be more conservative. Even if they get half of the covid revenue, there will still be a 20 to 25% return on this investment.

It’s a very beautiful property. I just put one picture here, but there is plenty of very beautiful pictures. This property was remodeled for $26 million in 2006, and we are buying it at $5 million. So it’s a rock bottom price, post-COVID, at this hospitality play that some people lost a lot of money on it, and we just coming and snooping after.

Great waterfall terms. We expect very high cash flow, and the exit cap rate is underwritten at 16%. So very healthy cap rate. Obviously, even for an event venue, even if the interest rate increase, the 16% gives us a lot of buffers. So we’re excited about this kind of last investment.

That’s 17 investments we made as part of the growth fund.

(comment) This is certainly an interesting investment. A lot of value and risk mitigation, is there? (Olivier) Yeah. Yeah. I think even if things don’t pan out as expected, we can still sell at the same price as we bought it for. There is no way it’s going to go, go lower than that. Right now, they have been increasing the price, the occupancy of the venue, and so on. They’re making more and more cash flow every quarter. So yeah, it’s like very optimistic about this. That was over-subscribed within less than a week.

All right. So I think we’re done through all the fund updates here. So you can see all emails: Saikrishna’s email, and Jeff’s email here. If you have some questions or you want more details, I’ll share the recording in the next few weeks. Let me see if there is some question on the chat.

Does anyone have a question?

(Question:) Yeah, I do have a quick question. So when you wire the fund to the sponsor, if they cannot close the deal, did they charge any fee, or did they just refund back to you completely?

(Answer:) Yeah. It depends. But on the one on Bayou Capital, they gave us back exactly the money we invested, so we only had some cash drag. It’s as if we had the money in a bank account for 6 months without any return. I see. Which is why on the FMV update for Q4 2022, we have a big distribution that we reinvested in that last investment on the Grand, the event venue. But the FMV update dropped to a negative number, like -1%, because all the expected returns from Bayou didn’t happen.

So we expected it was, like, a 2 or 3% increase in value, and that’s dropped to 0%, but the distributions compensated that completely. So it’s still gone up as a fund level. It’s still growth.

Any other questions?

I don’t have a question, but Olivier, thank you for putting this together. It is very deep content. Thank you. Investment details so far for the fund. I’m sure our investors should have an appreciation to this information.

Anyone else?

Do you, do you not find any in the chat? No, there is nothing. I don’t see anything in the chat. Okay, good.

Cool. Thank you, guys. I think maybe we can close this chat. Thank you, everyone. Thank you. Thank you. Bye. Bye-bye.